Explain Different Types of International Arbitrageurs

The key element in the definition is that the amount of profit be determined. Local Arbitrage One good one market It sets the price of one good in one market.

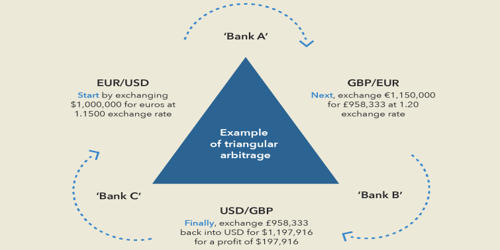

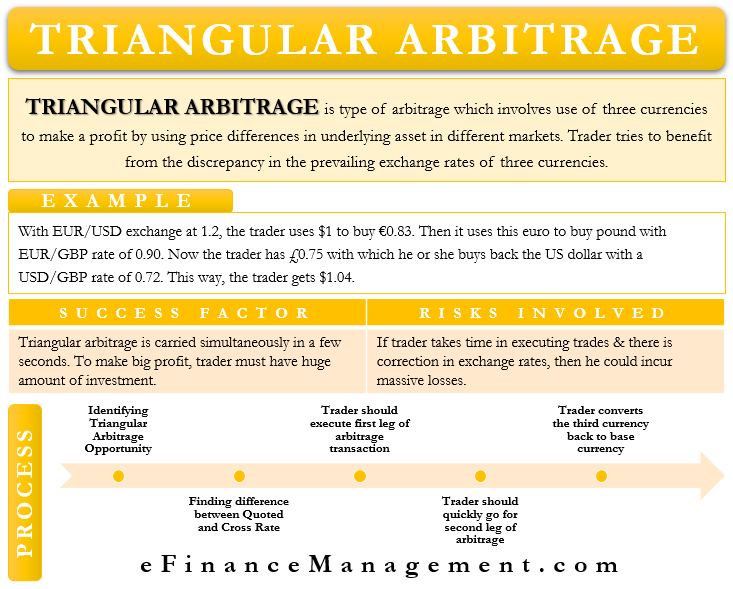

Triangular Arbitrage Opportunity

Financial intermediaries divide the securities into different categories which have different rights to cash flows from the asset pool.

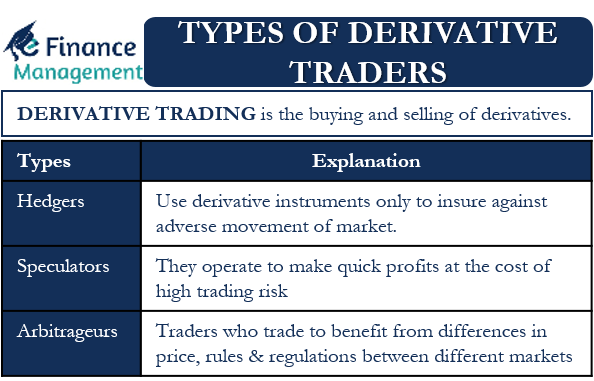

. Hedgers speculators arbitrageurs and margin traders. Data on FDI flows and the extended international stock market valuation and returns data assembled by Fama and French 1998. Foreign exchange markets are one of the most important financial markets in the world.

Arbitrage allows market participants to determine the true fundamental price of an asset. The BEA data cover. Options futures forwards and swaps.

There are four major types of derivative contracts. They are however less influential in shaping customer preferences in the market compared to the international innovators and producers discussed later in Quadrant iv. Telecom arbitrage companies allow phone users to make international calls for free through certain access numbers.

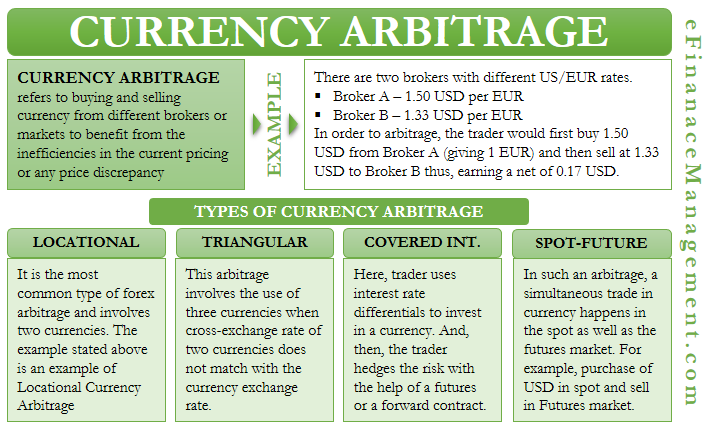

Here the arbitrageur takes an immediate buy and sell decision without blocking the funds. While arbitrage usually refers to trading opportunities in financial markets there are also other types of arbitrage opportunities covering other tradeable markets. Arbitrage is the process of a simultaneous sale and purchase of currencies in two or more foreign exchange markets with an objective to make profits by capitalizing on the exchange-rate differentials in various markets.

There are 3 types of arbitrage. Arbitrageurs are traders that take advantage of the price discrepancy in different markets to make a profit. Often investors estimate a price rise of the stock and thus block the money by buying and then holding itBasically the investors expect a price hike in another market.

Arbitrageurs serve an important function in the foreign exchange market. In which the buyer gives the right but not the obligation to buy or sell a certain asset at a later date on an agreed price. Kinds of Foreign Exchange Market.

Arbitrage activity enhances the. These are the main players of the foreign market their position and place are shown in the figure below. If for example they see the futures price of an asset getting out of line with the cash price they will take offsetting positions in.

There are two types of arbitrage by multinationals. It has no physical location and operates 24 hours a day for 5-12 days a week. Law of one price.

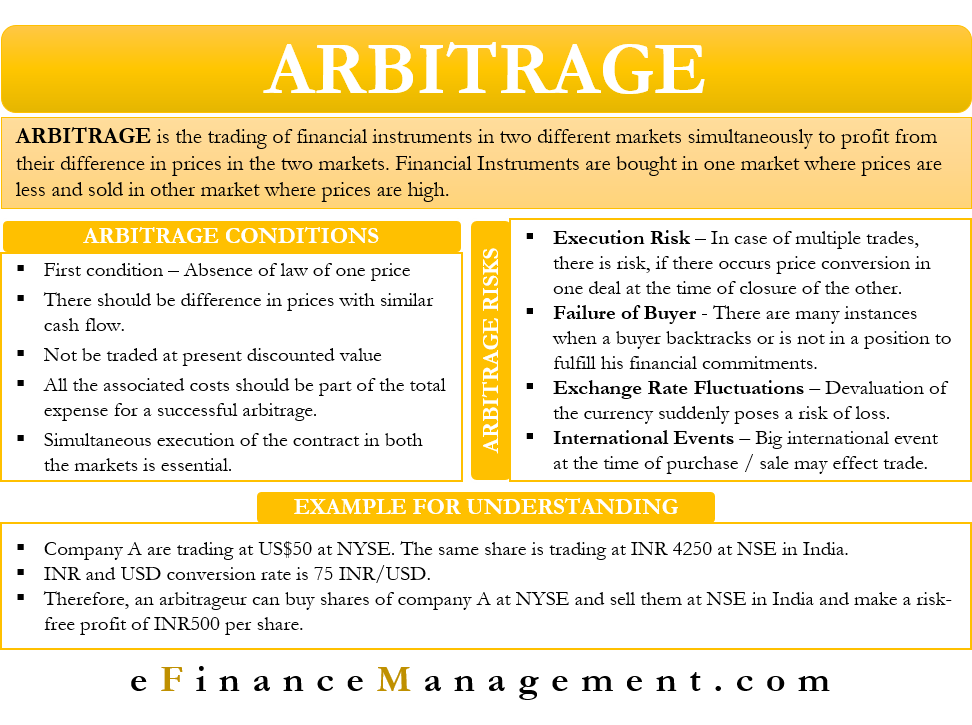

The arbitrage opportunities exist due to the inefficiencies of the market. The derivatives market refers to the financial market for financial instruments such as futures contracts or options. Different Types of Derivative Contracts.

The telecommunication arbitrage companies get paid an interconnect charge by the UK mobile networks and then buy international routes at a lower cost. The structure of the foreign exchange market constitutes central banks commercial banks brokers exporters and importers immigrants investors tourists. There are four kinds of participants in a derivatives market.

Arbitrage also occurs on a corporate scale. Arbitrageurs are in business to take advantage of a discrepancy between prices in two different markets Eg. These are standardized contracts and are traded on the stock exchange.

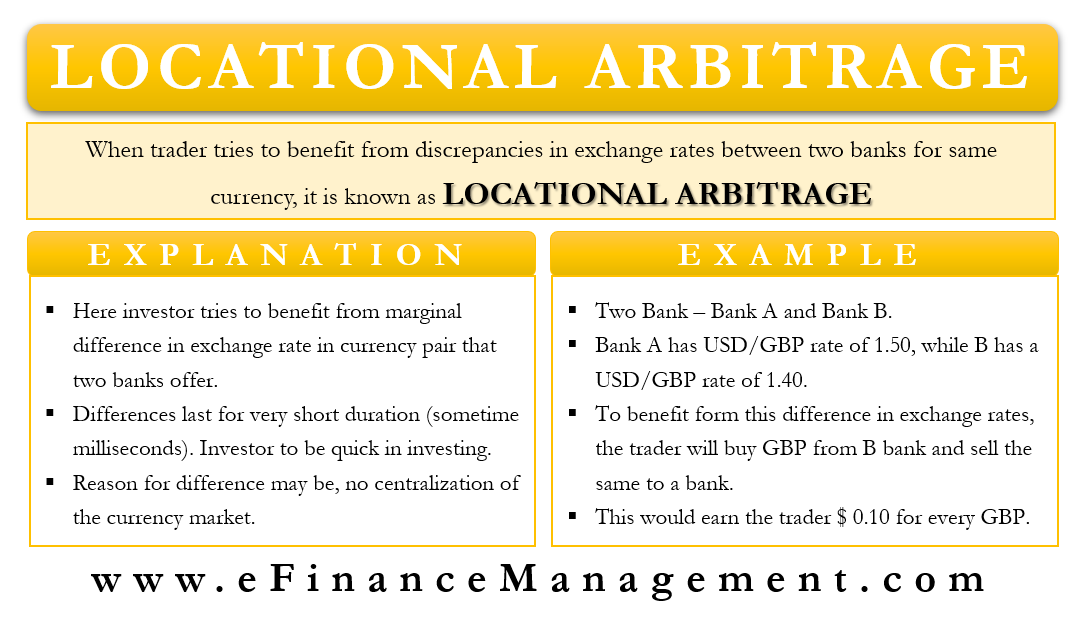

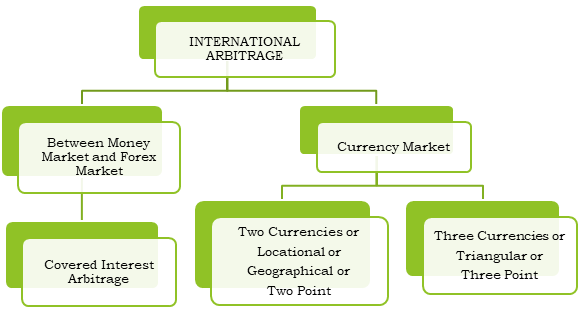

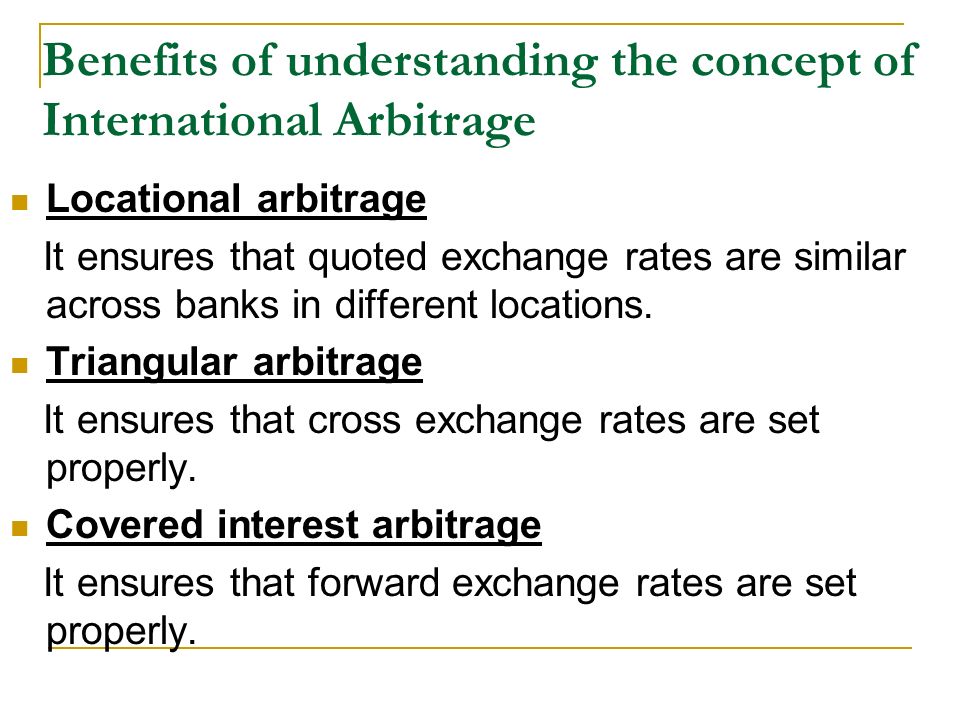

International outsourcers are Schumpeterian in that they engage in more innovative or creative activities in the creation of products than do international arbitrageurs Quadrants i and iii. The different kinds of arbitrage practices are as follows. 1 Local sets uniform rates across banks 2 Triangular sets cross rates 3 Covered sets forward rates 1.

Increase in the volume of international trade and business due to the wave of globalization and. Arbitrageurs by means of their activities ensure no divergence exists between different markets spot futures options for same asset class. In actual practice there are various different types of derivatives but this paper emphasizes on the two most important types of derivatives ie.

The foreign exchange market is a global online network where traders and investors buy and sell currencies. While dealing in the arbitrage trade an individual can make profits only out of price. Global labor arbitrage commonly called offshoring refers to a form of arbitrage in which companies move their assets to countries with the lowest labor costs paying less money for the same work.

The same good should trade for the same price in the same market. At the bottom of a pyramid are the actual buyers and sellers of the foreign currencies- exporters. Options are the agreement between the buyer and the seller.

Many cryptocurrency investors are. Usually they attempt to make a profit from market inefficiencies. The Effect of Stock Market Valuations on Foreign Direct Investment.

NSE and BSE. Trade at different prices in different markets. Those include risk arbitrage retail arbitrage convertible arbitrage negative arbitrage and statistical arbitrage.

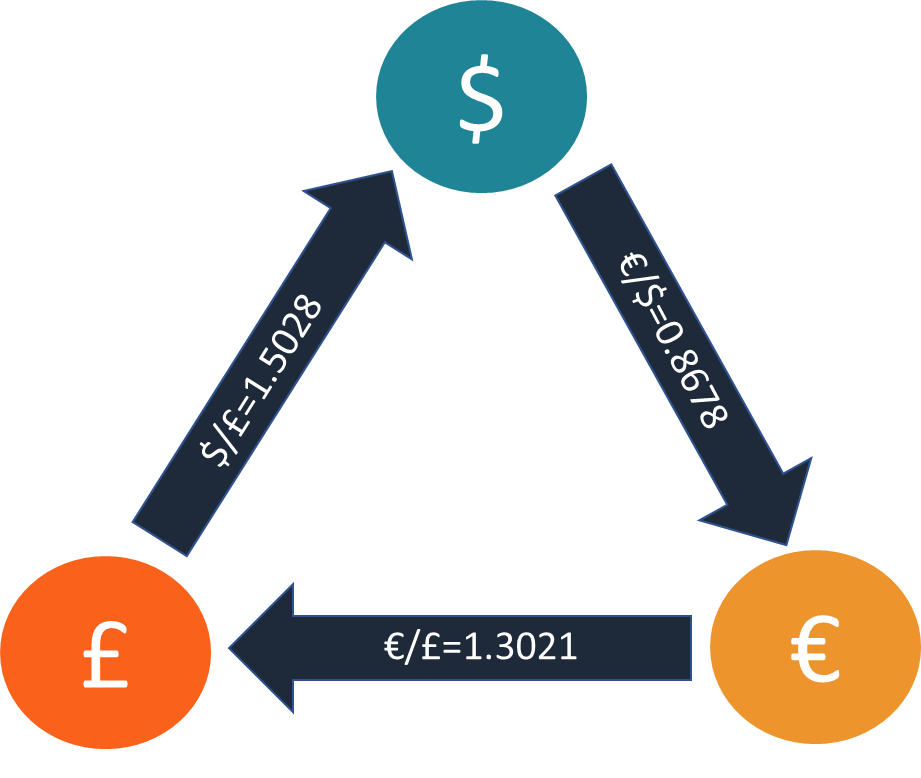

It is their operations that ensure that a market as large as decentralized and as diffused as the Forex market functions efficiently and provides uniform price. Types of arbitrage include risk retail convertible negative statistical and triangular among others. A Complicated Arbitrage Example A trickier example can be found in currencies markets.

Arbitrage is the opportunity to make consistent abnormal returns due to market inefficiency. Arbitrage also known as the law of one price means the ability to profit from price mismatches lasting for a very short time. Speculation Hedging and ArbitrageBIBLIOGRAPHYArbitrage is the simultaneous purchase and sale of equivalent assets at prices which guarantee a fixed profit at the time of the transactions although the life of the assets and hence the consummation of the profit may be delayed until some future date.

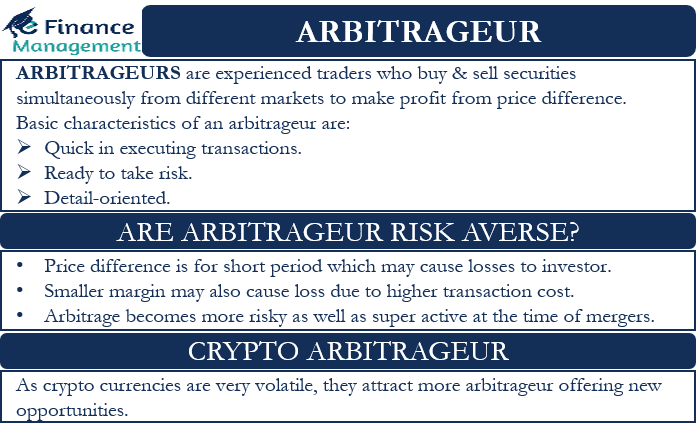

Arbitrageurs exploit price inefficiencies by making simultaneous trades that offset each other to capture risk-free profits. An arbitrageur would for example seek out price discrepancies between. They make a profit from market imperfections by taking advantage of the price difference between two or more markets.

Such services are offered in the United Kingdom. Question 5 Explain the benefits do arbitrageurs and speculators bring to derivatives markets. Risk arbitrage This type of arbitrage is also called merger arbitrage as it involves.

International Arbitrage Meaning And 3 Types Finance Cracker

What Is Arbitrage Trading In Forex How To Arbitrage Forex Forex Education

Arbitrage Meaning Conditions For Arbitrage Risks

International Arbitrage And Interest Rate Parity Ppt Download

Triangular Arbitrage Opportunity Definition And Example

International Arbitrage And Interest Rate Parity Ppt Download

Arbitrage Definition And Examples A Common Trading Strategy

Chapter 6 International Arbitrage And Interest Rate Parity

Locational Arbitrage Meaning Examples And More

Types Of Derivatives Traders Hedgers Speculators Arbitrageurs

Arbitrageur Who They Are What They Do And More

International Arbitrage Meaning And 3 Types Finance Cracker

Triangular Arbitrage Meaning Example Risks And More Efm

Arbitrage An Overview Sciencedirect Topics

Currency Arbitrage Meaning Types Risk And More

International Arbitrage Ppt Download

Comments

Post a Comment